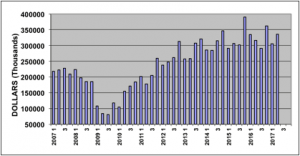

Plastics Machinery Shipments Escalated 6.0% Y/Y in Q2 of 2017

North American shipments of plastics machinery registered a year-over-year gain in Q2 of 2017 according to statistics compiled and reported by the PLASTICS Industry Association’s Committee on Equipment Statistics (CES).

North American shipments of plastics machinery registered a year-over-year gain in Q2 of 2017 according to statistics compiled and reported by the PLASTICS Industry Association’s Committee on Equipment Statistics (CES). This halted a trend of three consecutive quarterly declines in this data.

The preliminary estimate for shipments of primary plastics equipment (injection molding, extrusion, and blow molding equipment) for reporting companies totaled $335.6 million in the second quarter. This was 6.0 percent higher than the total of $316.6 million in Q2 of 2016, and it was 10.0 percent stronger than the revised $305.3 million from Q1 of 2017. This Y/Y gain in Q2 followed a revised 8.9 percent Y/Y decrease in the quarterly total from Q1.

“The shipments data for plastics equipment posted a solid gain in the second quarter, but it remains to be seen whether an upward trend can be sustained in the second half of the year. I believe a more likely scenario is that the data in the second half of this year will come in flat-to-down. The underlying economic fundamentals in the U.S. should continue to grind gradually higher, and global demand is also expected to improve moderately this year. If Congress passes corporate tax reform in 2017, then I still believe that an uptrend in the machinery data could re-emerge in 2018,” according to Bill Wood, of Mountaintop Economics & Research, Inc.

PRIMARY PLASTICS EQUIPMENT SHIPMENTS

The shipments value of injection molding machinery increased 9 percent in Q2 when compared with last year. The shipments value of single-screw extruders declined by 16 percent. The shipments value of twin-screw extruders (which includes both co-rotating and counter-rotating machines) jumped 56 percent. The shipments value of blow molding machines slipped down by 2 percent in Q2.

The eight-year upward trend in the auxiliary equipment data appeared to level off in the second quarter, but the level of activity remained strong. This comparison is based on estimated data at this time. Actual comparisons in this year’s quarterly auxiliary data to last year’s quarterly totals are unavailable due to a change in the number of reporting companies.

The mixed results from the various segments in the CES machinery data in the second quarter were weaker than the solid gains posted in two other data series that track the overall U.S. industrial machinery sector. According to data compiled by the Census Bureau, the total value for new orders of US industrial machinery jumped 14 percent in Q2 of 2017 when compared with the same period last year.

Another indicator of overall demand for industrial machinery is compiled and reported by the Bureau of Economic Analysis (BEA) as part of its GDP dataset. According to the BEA, business investment in industrial equipment increased 6.7 percent (seasonally-adjusted, annualized rate) in Q2 of 2017 when compared with the previous year.

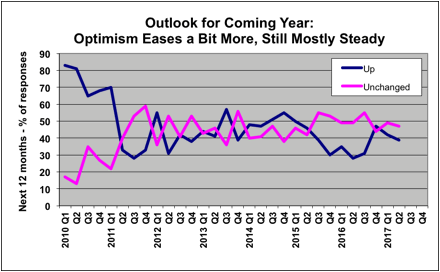

The CES also conducts a quarterly survey of plastics machinery suppliers that asks about their future expectations. According to the Q2 survey, 86 percent of respondents expect market conditions to either hold steady or get better during the next year. This is down moderately from 91 percent in Q1.

The outlook for global market conditions in the coming year was mostly steady in Q2. Expectations for North America called for steady-to-better conditions, but there was an increase in negative sentiment for the coming year. Mexico was expected to be mostly better. The outlook for Latin America called for steady-to-better, while the expectations for Europe and Asia called for mostly steady conditions.

The respondents to the Q2 survey currently expect that medical and packaging will be the strongest end-markets in the coming year. The expectations for demand from the automotive sector were mixed. The outlook for appliances, electrical, and construction sectors called for steady-to-better conditions. Demand from the industrial sector was expected to be mostly steady.

plasticsindustry.org